It is not surprising, since it has become the Republican way, but the Ryan plan to destroy Medicare and replace it with vouchers is being presented by Ryan and his party without any effort to tell the American people the truth, or provide accurate dollar figures showing what will really happen if the Ryan plan were to be instituted.

The Center for Economic and Policy Research has posted an in depth analysis of the proposal, and reveals it for what it is: A $30 Trillion Medicare Waste Tax.

The Congressional Budget Office’s (CBO) projections imply that the Ryan plan would add more than $30 trillion to the cost of providing Medicare equivalent policies over the program’s 75-year planning period. This increase in costs – from waste associated with using a less efficient health care delivery system – has not received the attention that it deserves in the public debate.

…

Based on the CBO (Congressional Budget Office) data provided, the waste far exceeds the savings to the government. Under traditional Medicare, the government is expected to spend about $6,600 in 2022 on a typical 65-year-old, and the beneficiary is expected to spend $4,600 (all numbers in 2011 dollars). Under the Ryan proposal, a voucher for the same 65-year old would cost the government $6,600, saving the government nothing. However, the total cost of purchasing Medicare-equivalent insurance would be $16,900 – more than 50 percent higher than the $11,200 spent by the government and beneficiary combined under traditional Medicare. The difference of $5,700 represents a gift to the private sector.CBO projects that private-sector inefficiency will grow over time. By 2030, the government would spend $7,200 on a 65-year-old in traditional Medicare. Since the cost of Ryan’s plan remains fixed at $6,600, it would save the government $600. (Following CBO the cost calculation is shown for a hypothetical 65 year-old even though people would not be eligible at age 65 in years after 2022.) But the total cost of insuring the beneficiary through the private sector would be $20,600, compared to $12,400 under traditional Medicare. For every dollar that the government would save on this beneficiary, it would generate more than $13 of waste.

…

By 2033, the Ryan plan fails to cover anyone between the ages of 65 and 67. While the Ryan plan would cover less than 30 percent of the cost of a 67-year-old’s private health insurance, it would cover none of that of the 65-year-old. If the Ryan plan’s increase in the age of eligibility goes into effect, a 65-year-old who bought into traditional Medicare plan in 2033 paying the full cost to the government would save more than 43 percent of the cost of buying Medicare-equivalent insurance due to the lower cost of getting insured through Medicare compared with private insurance. Traditional Medicare is almost entirely phased out by 2050.By gradually denying coverage to people up to age 67 and shifting costs off to those it would continue to cover, the Ryan plan saves the government $4.9 trillion from 2022 to 2084 – about the size of the Social Security shortfall over the same period. On the other hand, the private coverage is so expensive that the total cost is $34 trillion more than what would be paid under traditional Medicare. Seniors would be required to pay $39 trillion more under the Ryan plan – more than seven times the Social Security shortfall.

So what the Ryan plan does is push a massive expense in an inefficient market, the American for-profit health care system, onto the backs of the elderly, many of whom simply will not be able to afford it.

It does absolutely nothing to reform or improve the delivery of either health care insurance or the the delivery of services and their costs.

It is nothing but one more Republican plan to insure the transfer of as much money as possible from the pockets of the 80% of the population who are poor, working class, and middle class, into the pockets of the super rich and the corporations, who now own the vast majority of this nation, and are doing everything in their power to see that they get it all, if possible. As one recent study of the distribution of wealth in America points out, 20% of Americans own 93% of American Wealth and They Should All Get Tax Cuts. In fact, the Top 1 Percent Control 42 Percent of Financial Wealth in the U.S. – How Average Americans are Lured into Debt Servitude by Promises of Mega Wealth.

As I have written before, and will keep repeating to anyone reading this, and I mean these statements to be factual statements, not made up stuff like Republicans spout on the floors of the Senate and House:

2. Medicare functions at an overhead cost of only 5%. Private for-profit insurance functions at an overhead cost of over 17% , with some sources estimating as much as 30%%. In fact, the United States wastes more on health care bureaucracy than it would cost to provide health care to all of the uninsured.

As the study by CEPR concludes:

The CBO projections imply that the main effect of the Ryan plan will not be to shift costs from the government to Medicare beneficiaries. While there is projected to be a substantial shift of $4.9 trillion under the Ryan plan, this shift is dwarfed by the increase in overall costs due to the inefficiency of the private insurance system relative to the public Medicare system. The inefficiency of the private insurance system is projected to add more than $34 trillion to the cost of providing Medicare equivalent policies over the program’s 75-year planning period. This amount is almost more than six times the size of the projected Social Security shortfall.

This additional cost can be thought of as a tax since raising the cost of Medicare due to increased waste has approximately the same effect as increasing the cost by imposing a tax. For this reason the Ryan plan will have a comparable economic impact to imposing a $34 trillion

Of course, what this study calls waste, Republicans and the Corporate Oligarchy call profit. Which explains why they are behind this element of the continuing Billionaire’s Coup of America.

And since I cannot help but keep just repeating the simple facts, I will point out what I have said before about the deficit, taxes, and the lies of the Republican party.

I think what disgusts me the most about all of this is that the Republicans simply refuse to acknowledge the most elementary fact. Taxes are what support the government. Taxes for the rich are right now at the lowest point they have been in this nation in over a century. We would not be in the deficit mess as a nation we are except for two primary reasons: the unjustified and ongoing wars that the Republicans have gotten us into over the past decade; and the historically low tax rates instituted by the Bush era.

It has become more and more clear that corporations are not paying their fair share of taxes, either. To talk about the 35% taxation level on corporations is a joke. The tax code has been filled with so many loopholes, and the corporations have hidden so much of their earnings off-shore, that most large American corporations pay little or no taxes at all! GE is a perfect example.

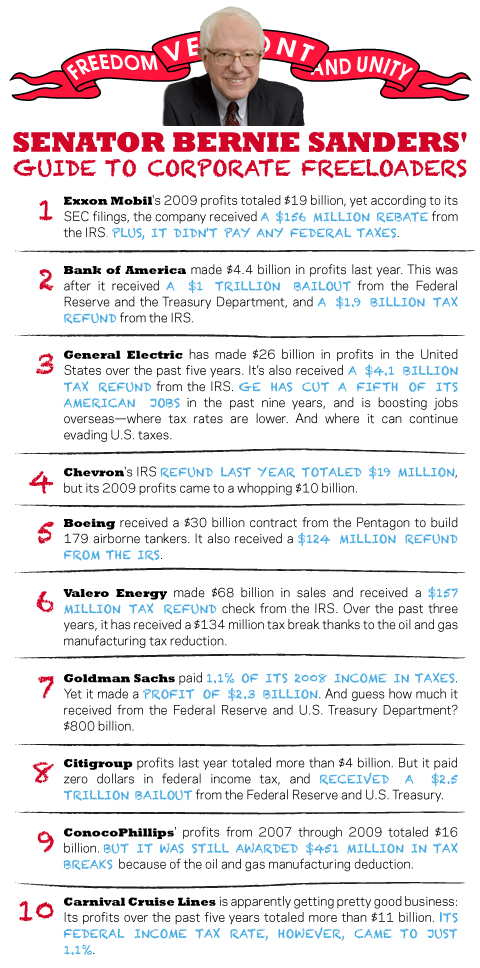

Senator Bernie Sanders of Vermont has put together a perfect illustration of the truth on the issue of corporations not paying their fair share. Here is Bernie Sanders Guide to Corporate Freeloaders. If some of the corporations names seem familiar, they should. Some of these are the same corporations who were bailed out of failure threatened by their own incompetence and criminal acts, bailed out with American tax payer money. All so they could avoid paying taxes, and further, turn around and use that same bailout money to insure buying the Congressional persons of their choice.

And here is a the most telling graphic, that shows the true source of the current deficit and our economic situation. This graphic sums it all up.

The deficit is not the problem. The stubborn refusal of the ruling class to pay their fair share of taxes is the problem. All of this nation’s deficit problems could be solved by four actions.

- 1) End the Bush tax cuts, and return rates to where they were 12 years ago;

- 2) End the loopholes that let most corporations pay practically no taxes, sometimes while actually getting government subsidies. GE, for instance, pays NO CORPORATE taxes, it was revealed recently, when they should be paying billions;

- 3) Absolutely no more taxpayer bailouts for Wall Street, the bankers, the hedge fund managers, and the corrupt real estate mortgage industry;

- 4) Bring our troops home. Get them out of Iraq. Get them Out of Afghanistan. Put an end to the Imperial Presidency that for decades now simply ignores the Constitutional Requirement for a Declaration of War before committing our troops.

As for the super rich, the corporations, and the rest of the masters of the universe who have created this economic mess, let the free market do its work when it applies to the ruling class, instead of blaming it all on the poor and Middle Class and kicking them when they are down.

What we have here is Government of the Rich, by the Rich, and for the Rich. In spades.

This post has been faxed to Representative Todd Young, IN-09; Indiana Senators Dick Lugar and Daniel Coats; The White House; House Speaker John Boehner; Senate Majority Leader Harry Reid; House Minority Leader Nancy Pelosi; Rep. Paul Ryan, R-WI; and and posted on this web site, http://keepamericafree.com. The web site provides links to documents on the web supporting the statements in this letter.