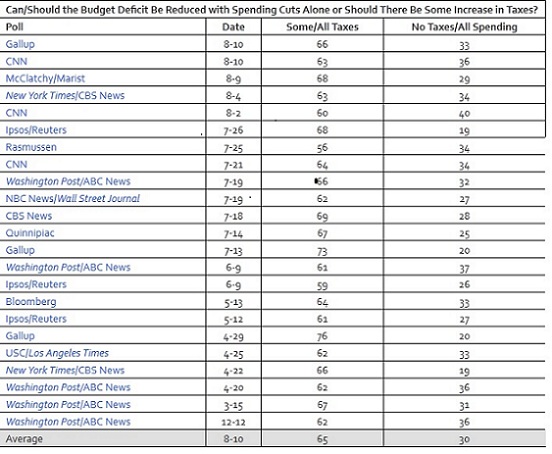

23 Polls Say People Support Higher Taxes to Reduce the Deficit

Posted without any need for comment, apparently, since it speaks for itself, by Bruce Bartlett, former Republican domestic policy adviser to Ronald Reagan, on his blog CapitalGainsandGames Washington, Wall Street and Everything in Between.

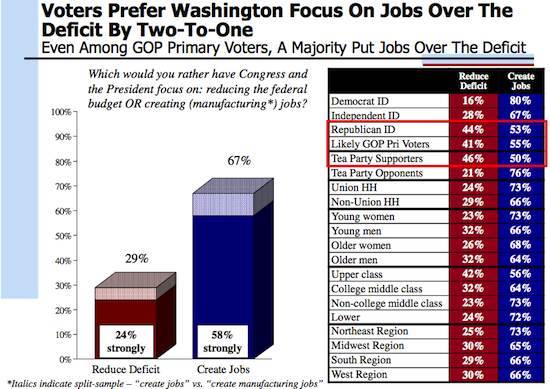

More than that, it is clear that a supermajority of the American people also clearly understand what is most important in these hard economic times, and that is the need for jobs, to keep the American people working, and to keep the economic engine turning.

The Democrats’ silver bullet for 2012: make it in America

Congress is standing by and letting American manufacturing die.

Congress is standing by and letting the American social safety net unravel, in fact, Congress seems intent on doing everything in its power to destroy it.

Congress is standing by while real unemployment rates continue at staggering levels unseen since the last Great Depression. In fact, Congress with its recent hysterical theatrics of the debt ceiling seems intent on not only causing a second Great Recession dip, but possibly even a Second Great Depression.

Is it any wonder that Congressional approval levels are at an all time, unheard of low? 14% approval in latest rounds of polls.

That’s the approval rating for Congress in the latest CNN/Opinion Research Corporation national poll. It’s the lowest approval rating ever for Congress in a CNN poll and one of only three times that approval has dipped below 20 percent.

(The other two times? March 1992 when approval stood at 18 percent and June 1979 when it was at 19 percent).

The “people hate Congress” story isn’t new — in fact it feels like it’s always been with us — but the depth of the unpopularity has taken on a different cast, according to two top strategists who have spent a lifetime studying political trends.

“Throw out the old play book,” said Tom Davis, a former Virginia House member and two-time chairman of the National Republican Congressional Committee.

Davis added that the “political establishment has delivered two failed wars, Katrina, an economic meltdown and stagnant wages,” and that “unless the economy improves the political system will go through shock therapy.”

The appalling disconnect from the reality of the current economic crisis and the devastating negative impact the actions of Congress are having is frightening. It is like watching a massive, slow-motion train wreck, caused by a Congress the majority of whose members simply refuse to deal in facts on any topic, be it economics, science, or society’s needs to insure the security and well-being of its citizens.

The distribution of wealth in America has reached the most staggeringly unequal levels in the history of the nation. It is obvious that the bailouts of the rich banks, hedge fund managers, and Wall Street have resulted only in temporarily propping up corrupt and failing institutions with the tax dollars of American’s, while those same majority of American’s are told they must sacrifice their savings for Social Security and Medicare to save the rich criminals.

What sort of mind set towards Americans does Congress display when it says, basically, hey, we borrowed your savings, we blew them away, and we are not going to give them back. That is, in essence, what is happening with the current Congress in regard to Social Security and Medicare.

The debt and deficit problems could be solved within a few short years just by letting the Bush era tax cuts on the super wealthy expire, and taxing for Social Security and Medicare above the current cutoff levels above which the wealthy no longer pay into the funds.

Even Warren Buffett, one of the richest men and most successful investors in the world, published an op-ed this week in which he very bluntly pointed out that it was nonsense for the super rich, like himself, not to pay a fairer share of taxes on their wealth, a share that would immediately begin to alleviate the nation’s current economic woes.

OUR leaders have asked for “shared sacrifice.” But when they did the asking, they spared me. I checked with my mega-rich friends to learn what pain they were expecting. They, too, were left untouched.

While the poor and middle class fight for us in Afghanistan, and while most Americans struggle to make ends meet, we mega-rich continue to get our extraordinary tax breaks. Some of us are investment managers who earn billions from our daily labors but are allowed to classify our income as “carried interest,” thereby getting a bargain 15 percent tax rate. Others own stock index futures for 10 minutes and have 60 percent of their gain taxed at 15 percent, as if they’d been long-term investors.

These and other blessings are showered upon us by legislators in Washington who feel compelled to protect us, much as if we were spotted owls or some other endangered species. It’s nice to have friends in high places.

Last year my federal tax bill — the income tax I paid, as well as payroll taxes paid by me and on my behalf — was $6,938,744. That sounds like a lot of money. But what I paid was only 17.4 percent of my taxable income — and that’s actually a lower percentage than was paid by any of the other 20 people in our office. Their tax burdens ranged from 33 percent to 41 percent and averaged 36 percent.

If you make money with money, as some of my super-rich friends do, your percentage may be a bit lower than mine. But if you earn money from a job, your percentage will surely exceed mine — most likely by a lot.

To understand why, you need to examine the sources of government revenue. Last year about 80 percent of these revenues came from personal income taxes and payroll taxes. The mega-rich pay income taxes at a rate of 15 percent on most of their earnings but pay practically nothing in payroll taxes. It’s a different story for the middle class: typically, they fall into the 15 percent and 25 percent income tax brackets, and then are hit with heavy payroll taxes to boot.

Back in the 1980s and 1990s, tax rates for the rich were far higher, and my percentage rate was in the middle of the pack. According to a theory I sometimes hear, I should have thrown a fit and refused to invest because of the elevated tax rates on capital gains and dividends.

I didn’t refuse, nor did others. I have worked with investors for 60 years and I have yet to see anyone — not even when capital gains rates were 39.9 percent in 1976-77 — shy away from a sensible investment because of the tax rate on the potential gain. People invest to make money, and potential taxes have never scared them off. And to those who argue that higher rates hurt job creation, I would note that a net of nearly 40 million jobs were added between 1980 and 2000. You know what’s happened since then: lower tax rates and far lower job creation.

Of course the ever reliable Faux Noise Nutwork immediately manufactured and started pushing the talking point on all its shows that “Warren Buffett was a SOCIALIST!”. Whatever that means. When Faux Noise Nutwork uses the word socialist, I don’t think it means the same thing I (or most of the sane, informed populace) think it means. Jon Stewart certainly picked up on this, and absolutely eviscerated Faux Noise Nutwork’s pushing of the talking points on his show. Transcript of some of this in the following quoting the various Faux Talking Heads spouting the line.

Wow. Bloody brilliant. They’ll be on vacation for the next two weeks, but Jon Stewart left with a bang, highlighting the Fox News reaction of shouting “Class warfare!!! Socialist!!!” to Warren Buffett’s op-ed calling on higher taxes for the rich. Instead, Fox News wants poor people to pay even more, while protecting the rich.

Warren Buffett’s op-ed was a thoughtful treatise on the advantages the super-wealthy currently enjoy at the hands of the tax code, or, to put that another way….

LARRY KUDLOW (8/15/2011): Up next tonight, Warren Buffett, class warfare.

NEIL CAVUTO (8/15/2011): More class warfare from an affable billionaire, who should stop assuming the rich are all billionaires.

ERIC BOLLING (8/15/2011): Warren Buffett wrote an op-ed … is he completely a socialist?

(shocked audience laughter)

Is Warren Buffett a socialist?? You really have no fucking clue what socialism is, do you? “Hey, that George Clooney, always banging different broads, what a queer!”

So closing a few corporate tax loopholes and returning the top marginal tax rate to the ’90s economic boom time levels is class warfare. And if there’s one thing the rich have learned, is that class warfare is hell.

LAURA INGRAHAM (6/29/2011): He invoked the corporate jet class, so that’s a whole new category of people to demonize, right?

STUART VARNEY (6/29/2011): Soak the rich, it’s their fault.

NEAL BOORTZ (7/14/2011): … Barack Obama’s tax on these evil disgusting corporate jet owners …

ANDREW NAPOLITANO (4/19/2011): … demonizing the rich as evil, as lazy, as inheritors of their wealth …

STUART VARNEY (8/18/2011): He’s saying they’re fat cats.

SEN. MARCO RUBIO, R-FL (6/30/2011): It’s disappointing, it’s class warfare, and it’s the kind of language that you would expect from a leader of a third world country, not the President of the United States.

Nobel Prize winning economist Paul Krugman gets right to the point on the sheer blind wrong-headedness of Congress on the current economic crisis, calling it “Awesome Wrongness”.

OK, seriously: things are looking really terrible, And crucially, they’re looking terrible in the wrong way, at least if you wanted to believe that political and policy debate over the past year and a half made any sense at all. We’ve been utterly preoccupied with deficits, deficits, deficits; there was supposedly a crisis looming, but a crisis that would take the form of an attack by the bond vigilantes.

…

But we came into this crisis with a pretty good understanding of what was at stake and pretty good analysis of the policy options — yet policy makers and, I’m sorry to say, many economists just chose to ignore all that and go with their prejudices instead.And the worst of it is that the people who got this so wrong have not and probably won’t admit to their awesome wrongness; on the contrary, they’ll dig in. And the Lesser Depression will go on and on and on.

Krugman is not alone in his increasingly strong statements on the threats to economic recovery and the possibility of another deep recession or even another depression. Simon Johnson is the former chief economist at the International Monetary Fund.

With the United States and European economies having slowed markedly according to the latest data, and with global growth continuing to disappoint, a reasonable question increasingly arises: Are we in another Great Depression?

The easy answer is “no” — the main features of the Great Depression have not yet manifested themselves and still seem unlikely. But it is increasingly likely that we will find ourselves in the midst of something nearly as traumatic, a long slump of the kind seen with some regularity in the 19th century, particularly if presidential election-year politics continue to head in a dangerous direction.